How to avoid fees when receiving USD Payment using Wise (f.k.a. TransferWise)

If you are a non-US blogger or an international freelancer, you’ll inevitably receive payment in different currencies from all over the world. With this, minimizing fees and hunting for a fair exchange rate becomes a perpetual issue.

Thankfully, we now have TransferWise. With them, fees became minimal and exhange rate are very fair.

TransferWise vs Paypal

Recently, I came across a question in a Facebook group I am a part of — what is the difference of receiving a USD payment with PayPal vs direct deposit vs TransferWise? Well, the difference mostly lies in conversion fees, which PayPal charges exorbitant amount for.

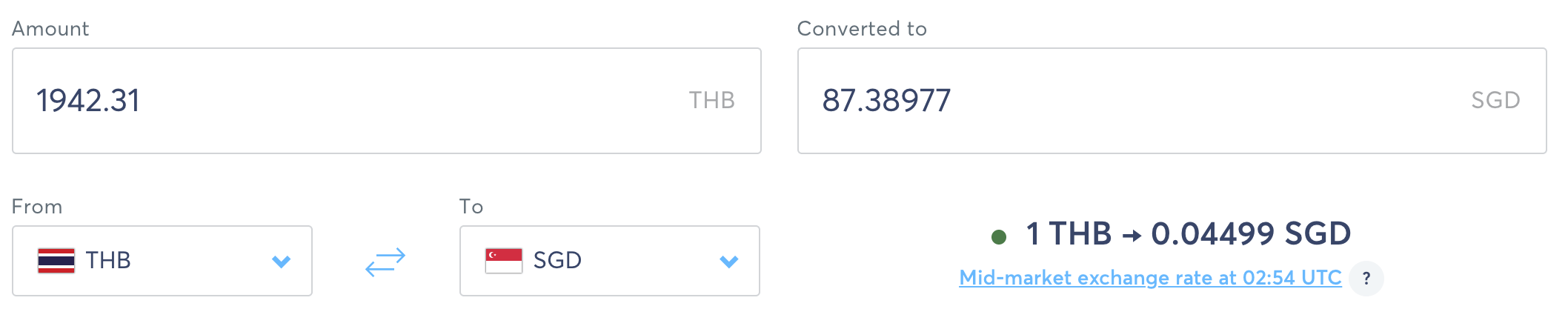

For example, I recently received a payment in PayPal for 1,942.31 Thailand Baht, which PayPal converted to $84.67 Singapore Dollars. At the same time, if I had received the payment in TransferWise, it would have been converted to $87.39 Singapore Dollars. Obviously this example is just a small amount, but if you receive payment in thousands of dollars this could translate to a lot more difference!

On the other hand, if you accept payment via direct deposit, then you’ll have no choice but to use your bank’s conversion fees which also tend to not be the best rate in town.

Both PayPal and Direct Deposit are not ideal situations for us— that is, until TransferWise Borderless Account became a thing.

A wonderful, fee-saving thing.

I’ve been accepting payment with TransferWise for 2 years since 2017, and I haven’t looked back.

Is TransferWise an option for you?

Transferwise supports converting and adding 40+ currencies, but the amount of currency they can accept is limited.

So first things first, check if your payment currencies (the currencies you are being paid in) is supported by Transferwise by checking the list here and that your base currency (what you use day to day and the currency of country where you live) is also supported by TransferWise - check the list here.

If the currencies you transact in are indeed supported, then you’re good to go! Here are steps of what I usually do (for the purpose of illustration, I will use USD as the payment currency and SGD as base currency, which is my personal experience):

1. Create a TransferWise account

Signing up for an account is easy AND free.

If you want to reward me for writing this article, you can do so by signing up using my TransferWise affiliate link: transferwise.com/i/melissap172

Full disclosure: I will receive $100 for every 3 referrals who signs up and only if they start using the product.

After signing up, you might need to provide some documentation to verify your identity. It has been awhile since I signed up, but I remember the process being extremely straightforward.

2. Create the Balances you need to transact in

Once you log in to TransferWise, go to Balances > Click on Add a Balance. This creates balances for currencies you plan to transact in — that is, the currencies you are planning to accept and your base currency for your local bank account.

Do this for all the currencies you will be using. For me, I accept payments in USD and EUR, while my base currency is SGD. So I created balances for those three currencies in TransferWise: USD, EUR and SGD.

For some of these balances, you will get a local bank details from TransferWise, which means you can start accepting payments in that currency!

3. Start accepting payments through TransferWise

Go to whoever / wherever you need to accept payment from. If it’s a client, send them the TransferWise local bank details for the currency you are accepting. If it’s a company, simply update your payment information on their payment system with your TransferWise details.

You can get your TransferWise local bank details by going to Balances in TransferWise and clicking on the currency, which will expand and show you a local bank detail for that currency.

Example: How I accept payment through TransferWise

One of my source of income is Mediavine, which pays me for ads I display on my travel blog. I know many non-US bloggers struggle with this, so I will use Mediavine as an example.

Mediavine pays in USD, so make sure you’ve created a USD Balance and get your USD local bank details ready (Refer to Step 1 and 2 above). Then, go to Mediavine dashboard and set your payment country to United States. You can then have the option to get paid with Direct Deposit / ACH to your USD Transferwise local bank account, which incurs no fee! What I earned is what I see on my TransferWise balance.

4. Convert your payment to your base currency

This process is the most straightforward one — simply go to Balances again in TransferWise, and click on the balance of payment you’ve just received and convert it to your base currency!

I’ll use the Mediavine example again. When Mediavine pays me my earning in USD, I’ll convert what I’ve received in USD into SGD within TransferWise. This is where TransferWise really have the upperhand over the other payment methods — it has a much better conversion rate than PayPal / your local bank, almost the same as what you would see on Google or XE Currency. It also has a VERY small conversion fee, regardless of how much or how little you convert.

PS: Unrelated to fees, but you might still want to check and compare if the currency conversion is good before your transfer. Sometimes I hold off a few weeks until I think the rate is the best for that month.

5. Receive Payment in Your Bank Account… PROFIT!!

In TransferWise, go to Recipients > click on Add your Bank Account, and fill in the necessary bank details. You should have all these information from your bank.

Once that’s done, Simply transfer your base currency to your local bank from TransferWise. Depending on where your local bank is located, you might incur a very small transfer fee.

In my case, I am located in Singapore and the transfer fee is a mere $1.40 per transfer, no matter how big or small, which I am very happy to pay once a month!

Cautionary Tales: Using TransferWise might get you charged if going through SWIFT

By using TransferWise, you normally incur no fee aside of conversion fee and the transfer fee, which again is much better than PayPal or doing a direct deposit straight to your bank account.

HOWEVER, there is a big IF here — TransferWise cannot control how much it receives from your client / payee. So make sure your client is using a method that will incur no transfer fee! In my experience, if you are accepting a USD Direct Deposit with ACH, there will be no additional fee. I also did not incur any additional fee when I accept a Wire Transfer for my EUR earnings. I use this very same method for my other earning from Mediavine, Booking.com, travel affiliates and Amazon. So far, I have not had to pay any fees for them.

But I noticed that I have been charged a fee only when an international client from Hong Kong sent me USD using SWIFT payment - I was charged US$27 for it. Another time, I was accepting a USD payment from a client in London and was charged US$25 for it. On top of that, TransferWise also started charging $7.50 for using SWIFT.

So, before using TransferWise, make sure you know where your client will be sending money from and what payment method your client would be using! Generally, if you are receiving USD payment but your client is located outside of US or sending money from a location outside of US, there is a high chance they might use SWIFT and you will be charged. In that case, you might want to accept the payment through different means. But if your client is located in the US and sending USD from a bank in the US, then you should be fine.

And that’s all folks!! If you are having issues, get in touch and I’d be happy to walk you through my setup or share what I know!